IMPORTANT NOTICE

We are experiencing an outage with our E-Mail. For any inquiries please

GIVE US A CALL

Financial Planning

& Our Approach to

Wealth Bridge Advisory

WELCOME TO

Scroll to Read More

WELCOME TO

Wealth Bridge Advisory

& OUR APPROACH TO

Financial Planning

For Over 30 Years

We have Helped our Clients

Which leads to the purpose of Wealth Bridge Advisory…

Our Purpose

…IS TO PRESERVE, PROTECT, AND PERPETUATE OUR CLIENTS’ WEALTH FOR THEMSELVES AND THE PEOPLE THEY LOVE…

Preserving your wealth and income for the rest of your life

Protecting your wealth against the risks of the market and personal tragedy

Perpetuating your wealth for future generations and gifting

We Want You to Have These Complimentary Planning Guides

To help fulfill our purpose, we have developed a philosophy of beliefs that has become ingrained in the way we conduct our business:

Our good fit test

Are you a good fit for our firm?

WITH 3 RESOUNDING YES RESPONSES, WE ARE PREPARED TO BE THE BRIDGE TO YOUR FINANCIAL SECURITY

Creating the future…

The Best Way to Predict

the Future is to Create It

ABRAHAM LINCOLN

And How do You Create the Future?

By Planning For it.

Our Planning Process Begins with this Understanding...

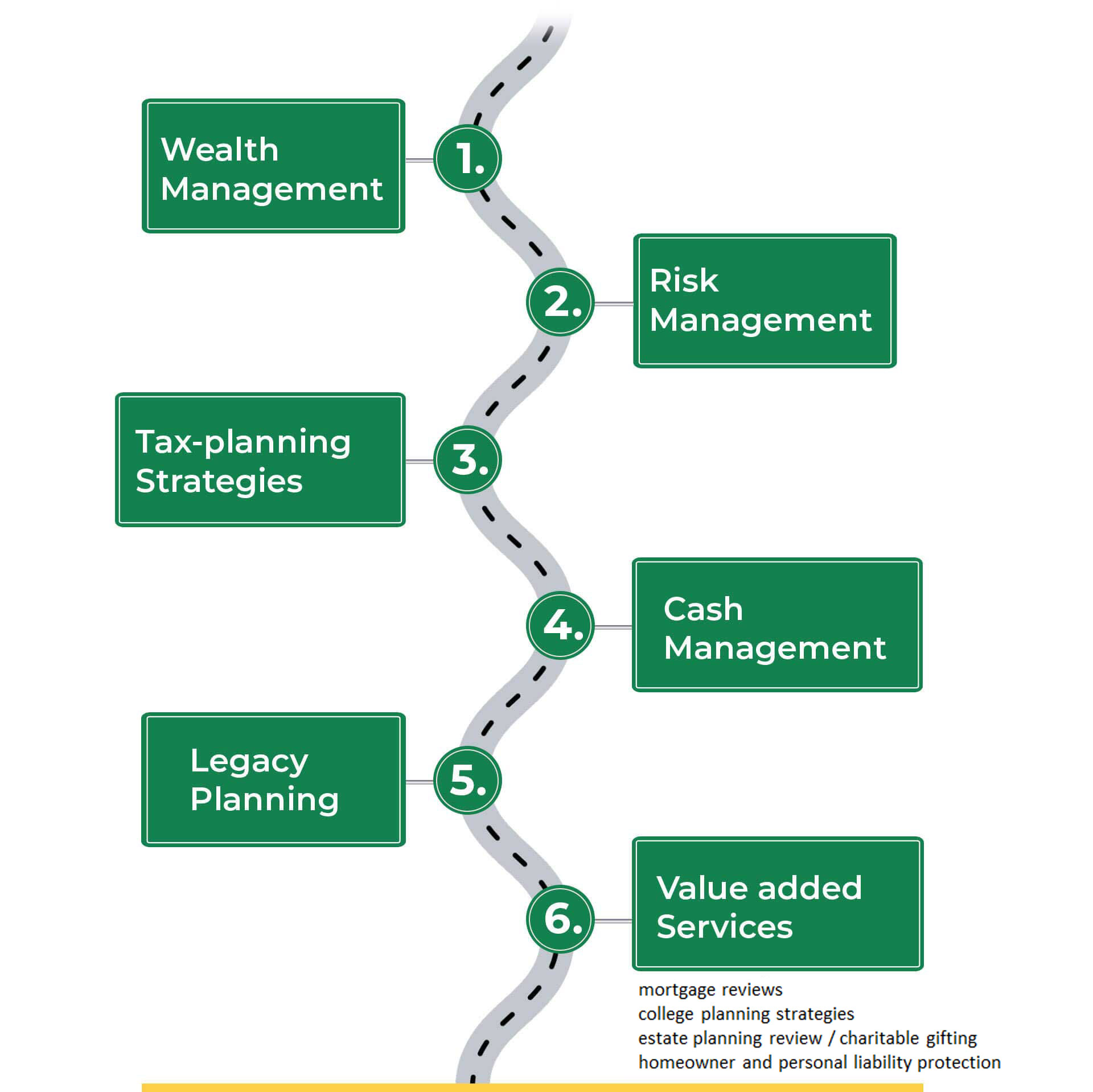

Our Approach to Financial Planning

uses Six

Critical Road-Posts to build

a Comprehensive…

Or Panoramic…

View of Your Financial Roadmap..

FAQ

Frequently Asked Questions

A comprehensive financial plan is essential for securing your financial future, offering a structured approach to managing your finances. It acts as a roadmap that not only helps you prioritize your financial goals but also provides a clear path for achieving them. Creative financial planning can make all the difference in the success of your retirement.

We operate under a Fee-Based system. We charge a clear and transparent fee for managing your portfolio. This approach aligns our interests with yours: when your investments perform well, we also do better. Additionally, we provide comprehensive financial planning services at no extra charge or obligation. This ensures you receive all the guidance and support you need to make informed decisions…without worrying about hidden fees.

No. Wealth Bridge Advisory is a comprehensive one-stop shop offering a full range of services and products to meet your financial needs. By consolidating these offerings, we help you effectively plan, compare, and evaluate each option to ensure they align with your long-term financial goals.

Of course, we will. We work with all of our clients’ professionals. And if you need a recommendation to an accountant, estate attorney, or a mortgage originator, we can certainly make recommendations.

The first step would be getting to know you – and not just your financial picture, but you as a person. At Wealth Bridge Advisory we take a holistic approach to financial planning , which means we want to understand your hopes, dreams, and the things that matter most to you…in addition to the concerns that keep you up at night. We believe that building a deep understanding of you and your family is essential for creating a financial strategy that is not just effective, but meaningful. As your financial advocate, this personalized, relationship-based approach sets the foundation for everything we do…and separates us from other advisors.

Wealth Bridge Advisory Founder William M. Greenfield, CLU, ChFC

Contact

Newsletter

Sign up for updates.

bill@wealthbridgeadvisory.com

126 Forest St., Unit 126

Stamford, CT 06901

(856) 888-1090

Securities offered through World Investments, Inc., a full-service broker-dealer and member of FINRA / SIPC.

Investment Advisory services offered through World Advisory Services, an SEC Registered Investment Advisor.